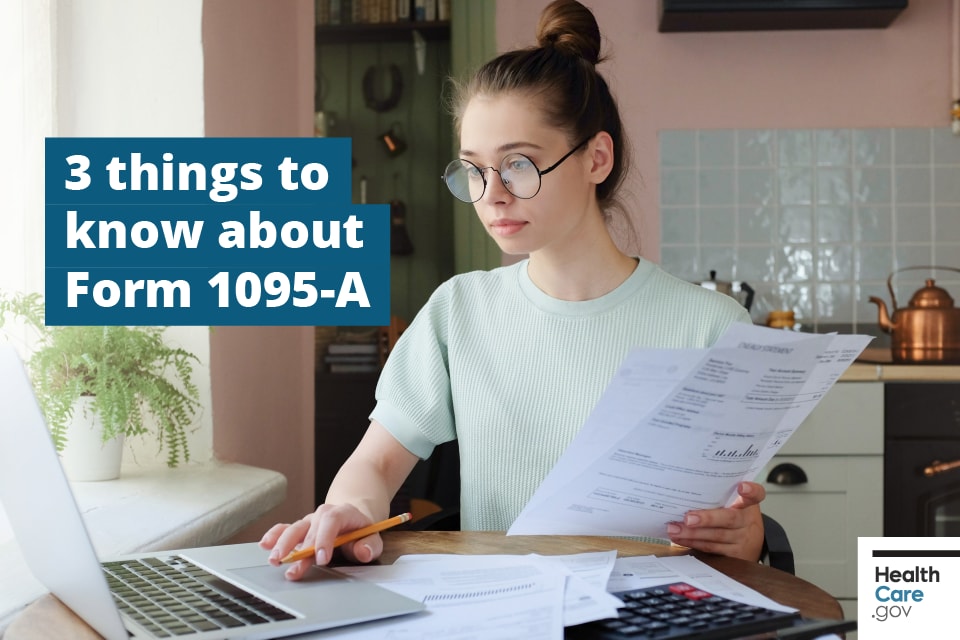

How to check your Form 1095-A

If anyone in your household had Marketplace health insurance in 2018, you should have already received Form 1095-A, Health Insurance Marketplace Statement, in the mail.

Before you file: 3 things to know about Form 1095-A

- If you can’t find your 1095-A, check online. If your form didn’t come by mail or you can’t find it, check your online Marketplace account. When you follow these steps, be sure to choose your 2018 application, not your 2019 application.

- Before you file, make sure your 1095-A is correct. Check basic health plan and household member information, and verify the premium for your second lowest cost Silver plan (SLCSP). If you find errors, contact the Marketplace Call Center. Don’t file your taxes until you have an accurate form.

- You’ll use the information from your 1095-A to “reconcile” your premium tax credit. Once you have an accurate 1095-A and second lowest cost Silver plan premium, you’re ready to fill out Form 8962, Premium Tax Credit, and “reconcile.” You’ll compare the amount you used in 2018 to lower your monthly insurance payment with the actual premium tax credit you qualify for based on your final 2018 income. Get a step-by-step guide to reconciling.